Valuing a business based on revenue and growth rate is more important for your own business.

Putting a value on a business for sale is not always as simple as taking the yearly cash flow and multiplying it by four. When evaluating the sale price of an online business you need to factor in not only the current revenue, but also the rate of growth and the forecast revenue that YOU will be able to generate from it.

If the vendor of the Digital Assets has consistently reinvested profits back into the business and made changes to achieve certain milestones, then the company will continue to grow faster and the value will be higher. Add the extra income that you can generate from it changes the whole story.

What you do to add value and increase exponential growth over the next three years will not only determine your future income, but also the value of the business for resale.

Revenue Multiple

A revenue multiple measures the total value (market capitalisation) of a business relative to the revenue that it generates. i.e. Businesses that trade at low multiples of revenues are viewed as low cost compared to companies that trade at high multiples of revenues.

As a general guideline, 1x – 5x revenue multiple is the base range. Revenue multiples can vary significantly during the startup phase and will usually stabilise over time.

Big Public Listed Companies are Easier to Value

Large successful companies that are listed on an exchange like ASX or NASDAQ calculate their revenue multiple by dividing market capitalisation by the total annual revenue.

Market capitalisation is the value of a company that is traded on the stock market (calculated by multiplying the total number of shares by the present share price).

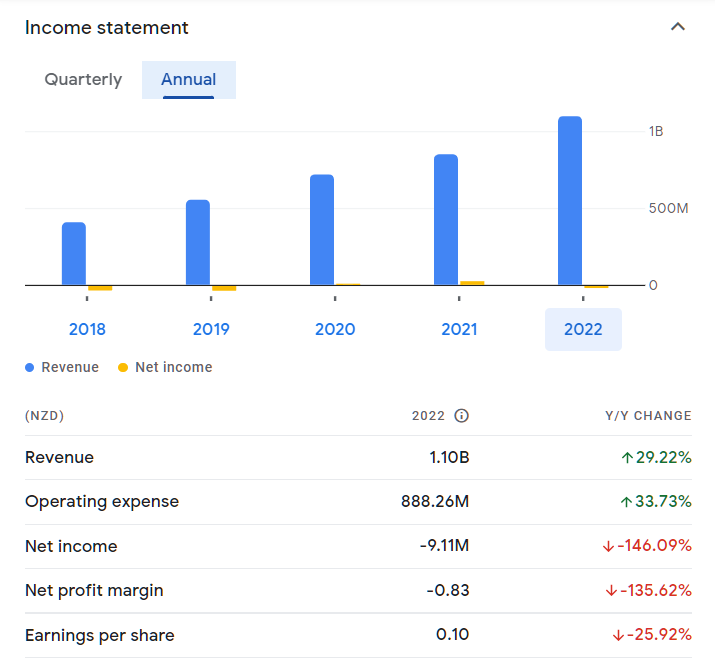

The Market Value of Xero

Accounting software firm Xero is valued at a revenue multiple of 9.6 calculated as follows:

Revenue: $1.10B

Market Capitalisation: $10.56B (can change hourly depending on their share price)

Revenue multiple = 9.6

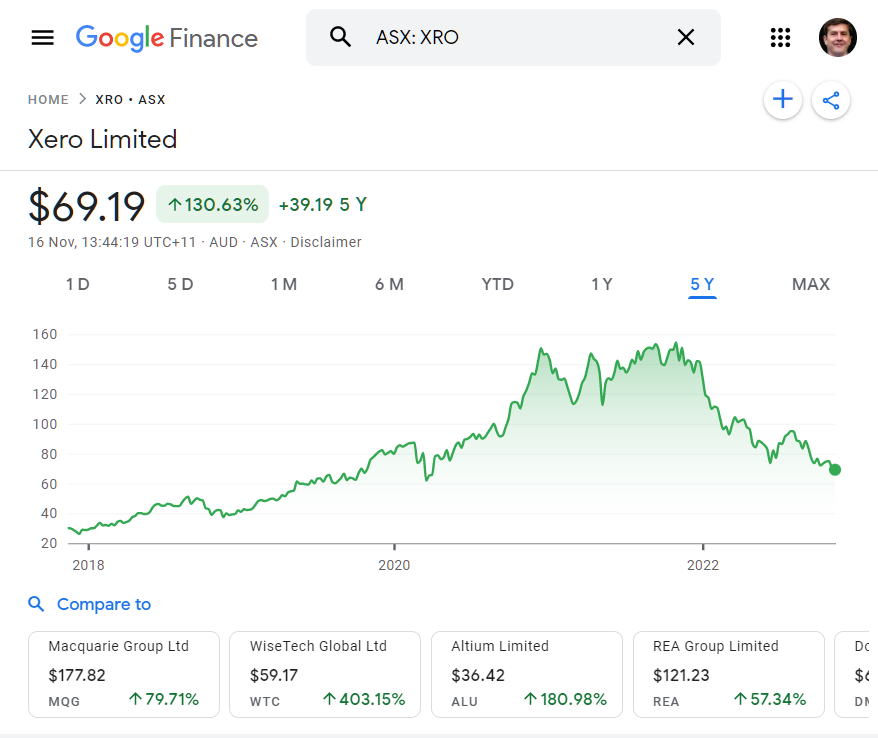

Your Financial Return for Buying Shares in Xero Online Accounting

If you look at the return for buying shares in Xero you can see that you would have made 130% IF you bought them back in 2018 but not so well since 2021. The problem with buying into any of these large businesses is that you’re hoping to make money on the value of the business increasing.

Xero doesn’t pay a dividend and keeps their profits very close to Zero so as a Xero shareholder you don’t even earn a half yearly income by owning their shares.

If you owned your own online business you could increase your own revenue each year by promoting your own services as a trainer, tutor, bookkeeper or accountant. That is the difference between owning shares in a large company compared to owning your own online business. Yes, it means that you become actively involved in the business but you then have the opportunity to earn much more than if you owned shares in Xero.

You Might Try Harder to Earn Money Than Steve Vamos

The other big difference between owning shares in an online business and owning your own online business is that you can more directly affect the financial performance of your own business. Big businesses hire CEO’s who try to do the best they can but as you can see from Claude Walker’s great article about Xero’s recent financial performance they don’t always do a good job.

With the right training and support you can add $50,000 or more to your own annual income! That extra income also helps to make your own online business more valuable.

Let’s look at Intuit for another example.

Intuit

Intuit is a large American software company that specialises in financial software. They are consistently profitable and their total market capitalisation is $US115.01B, with last year’s sales totalling $US12.73B.

Market Capitalisation ÷ Revenue = Revenue Multiple

$US115.01B ÷ $US12.73B = 9.03

You can see that their revenue multiple (total value) is about 9X.

Tesla

Although they operate in a very different market to the two examples above, it’s worth taking a looking at Tesla’s value due to their rapid growth and excellent prospects for future expansion.

Revenue: $53.82B

Market Capitalisation: $614.07B

Revenue multiple = 11.41

These values are reasonable for large companies, but smaller private companies are valued differently, and usually lower.

Valuation of Small to Medium Sized Companies

The online training course business for sale at EzyEstate is valued at 2.4 X 2022 revenue because it has grown at well over 30% p.a. on average and all the hard work for the first 2 years (more actually) has all been done for you.

If the business achieves its forecast growth of 50% in the next year, the price based on 2023 revenue might be 1.6 or lower. It’s for these reasons that you should strongly consider how you can add value and extract more income from an online business in the next three or so years.

Summary

The value of an online business is higher if the company is growing faster and has more prospects for the future. When considering the Information Memorandum for a business and its value for money, it’s important not to overlook the value of historical actions that will influence future revenue growth and subsequently, the sale price.

The Value in Buying an Online Business Is Your Income in the Next 3-5 Years

You can use trends to try to forecast future earnings and profit but businesses are very dynamic and future performance usually depends on what the new owner does with the business.

Online Training Course business – 30% pa growth including customer base and training available for sale

This online training business is perfect for the upskilling and retraining needed by a massive number of Australian jobseekers. Good margins, training and support and growing at 30% p.a.